extended child tax credit portal

How To Change Your Direct Deposit Information on the Child Tax Credit Update Portal Checks in the amount of either 300 or 250 will be deposited. The fourth installment of this years Advance Child Tax Credit is set to hit bank accounts today Fri Oct.

A Complete Guide On Income Tax Refund Status Income Tax Income Tax Return Income

Get this years expanded Child Tax Credit File your taxes to get your full Child Tax Credit now through April 18 2022.

. A qualifying child who is under age 18 at the end of 2021 and who has a valid Social Security number. Tax season brings its fair share of uncertainty for us non-CPAs and thats even more true this year. Child Tax Rebate Program The child tax rebate which was recently authorized by the Connecticut General Assembly and signed into law by Governor Ned Lamont is intended to help Connecticut families with children.

You may be eligible for a child tax rebate of up to a maximum of 750 250 per child up to three children. It also provided monthly payments from July of 2021 to December of 2021. CLICK HERE to go to the IRS Child Credit Portal for more information.

The American Rescue Plan increased the Child Tax Credit to 3600 for qualifying children under 6 and 3000 for qualifying children 6-17. This tax credit is changed. On May 11 the White House in partnership with the US.

The Update Portal is available only on IRSgov. It also made the parents or guardians of 17-year-old children newly eligible for up to the full 3000. The American Rescue Plan significantly increased the amount of Child Tax Credit a family could receive for 2021 typically from 2000 to 3000 or 3600 per qualifying child.

Advance child tax credit payments in 2021 reduced child poverty by 40. Half of the money will come as six monthly payments and. Get help filing your taxes and find more information about the 2021 Child Tax Credit.

In addition the American Rescue Plan extended the full Child Tax Credit permanently to Puerto Rico and the US. As part of its COVID-19 relief package Congress has changed the requirements and amounts of certain tax credits hoping to ease the financial burden weighing on many familiesOne of the biggest changes has been the expansion of two tax credits the child tax. Eligibility for advance payments Bank account and mailing address Processed payments.

Prior to this years expansion families received a credit of up to 2000 per child under age 17. The IRS will pay 3600 per child to parents of young children up to age five. Eligible applicants can now apply through the Department of Revenue Service portal by clicking on 2022 CT Child Tax Rebate.

In 2021 a full 3600 child tax credit was available to couples making less than 15000 or 75000 for singles. IRS Child Tax Credit Portal and Non-filers The advance Child Tax Credit or CTC payments began in July 2021 and end by 2022. The expansion imposed as part of the coronavirus relief plan offered families 3600 for children.

The enhanced child tax credit payments are only set to last through 2021 but President Biden has suggested that this may be extended through as long as 2025 as part of the American Families Plan. The letter says 2021 Total Advance Child Tax Credit AdvCTC Payments near the top and Letter 6419 on the bottom righthand side of the page. The child tax credit is up from 2000 to 3600 for kids under six and 3000 for children six to 17 years old.

Applications opened on June 1 and families that are eligible for the credit are set to get a maximum rebate of 250 which is capped at three children for a total of 750. Millions of families received up to 300 per child in monthly payments from July to December 2021 if they were eligible. And Made less than certain income limits.

The credit will be fully refundable. In December 2021 the IRS started sending letters to families who received advance Child Tax Credit payments. Applications must be submitted by July 31.

A recent study published by the Urban Institute shows that if the child tax credit is extended beyond 2021 it could substantially reduce child poverty in the vast majority of. They were able to claim up to 1800 followed by another 1800 on their tax returns this year. Biden administration has relaunched the simplified non-filer sign-up tool for low-income families who have yet to claim their expanded Child Tax Credit Families must claim their expanded Child Tax Credit by October 2022 Counties remain a critical partner in encouraging families to use the simplified portal to claim their credit.

Treasury Secretary Janet Yellen on child tax credit The expanded child tax credit includes up to 3600 per child under age 6 and 3000. The American Rescue Act of 2021 temporarily increases the Child Tax Credit up to 3600 per child under age six and up to 3000 per child under age 18. Credits increase from 2000 to 3600 per child under 6 and 3000 for children older than 6.

For purposes of the Child Tax Credit and advance Child Tax Credit payments your modified AGI is your adjusted gross income from the 2020 IRS Form 1040 line 11 or if you havent filed a 2020 return the 2019 IRS Form 1040 line. The IRS recently upgraded the Child Tax Credit Update Portal to enable families to update their bank account information so they can receive their monthly Child Tax Credit payment. The tool also allows families to unenroll from the advance payments if they dont want to receive them.

Havent Received a Child Tax Credit PaymentCheck if Youre Eligible Find. This story is part of Taxes 2022 CNETs coverage of the best tax software and everything else you need to get your return. This is what it looks like PDF.

President Biden has proposed extending the enhanced Child Tax Credit including monthly payments for at least 2022. View the Child Tax Credit Update Portal Use this tool to review a record of your.

Gstr 9 Format What Is Gstr 9 Format Internal Audit Account Reconciliation Legal Services

White House Unveils Updated Child Tax Credit Portal For Eligible Families

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

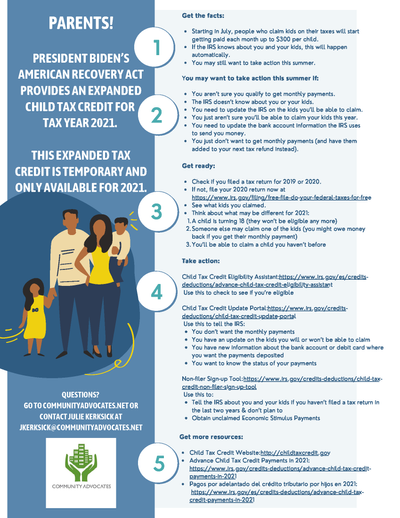

Child Tax Credit What We Do Community Advocates

Cbic Issues Notices To Companies For Itc Refund With Interest Indirect Tax Company Data Analytics

Help Is Here The Expanded Child Tax Credit Congressman Emanuel Cleaver

Step By Step Guide For Filling Of Gstr 2 Form Gst India Goods And Services Tax In India Goods And Service Tax Goods And Services Form

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

What Families Need To Know About The Ctc In 2022 Clasp

Gst Collections Hit 1 Lakh Crore Mark For 4th Consecutive Month Marks Data Analytics Filing Taxes

Did You Know That The Career Center Can Also Help With Tax Credits Click To Read More About The Enterprise Zone Sjsu Helpin Career Tax Credits The Fosters

Free Editable Startup Funding Proposal Template Word Template Net Startup Funding Proposal Templates Up Proposal

Journalism The Portal To An Exciting Future Journalism Educational Consultant Portal

Income Tax Services In 2022 Income Tax Tax Services Income Tax Service

Gst Cbic Extends Gstr 9 And Gstr 9c Filing Dates In A Staggered Manner Retail News Goods And Service Tax The Borrowers

Why Choose Solar Solar Energy Design Solar Energy Renewable Energy Technology

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Types Of Gstr 9 Returns Business Tax Deductions Business Tax Tax Deductions